idaho inheritance tax rate

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Please note that this is Indiana sales tax and must be remitted to the Indiana Department of Revenue.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Prior to July 1 2020 the tax rate was 7.

. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Beginning July 1 2020 the Indiana sales tax required to be collected from the purchaser from these states is rate indicated on the table.

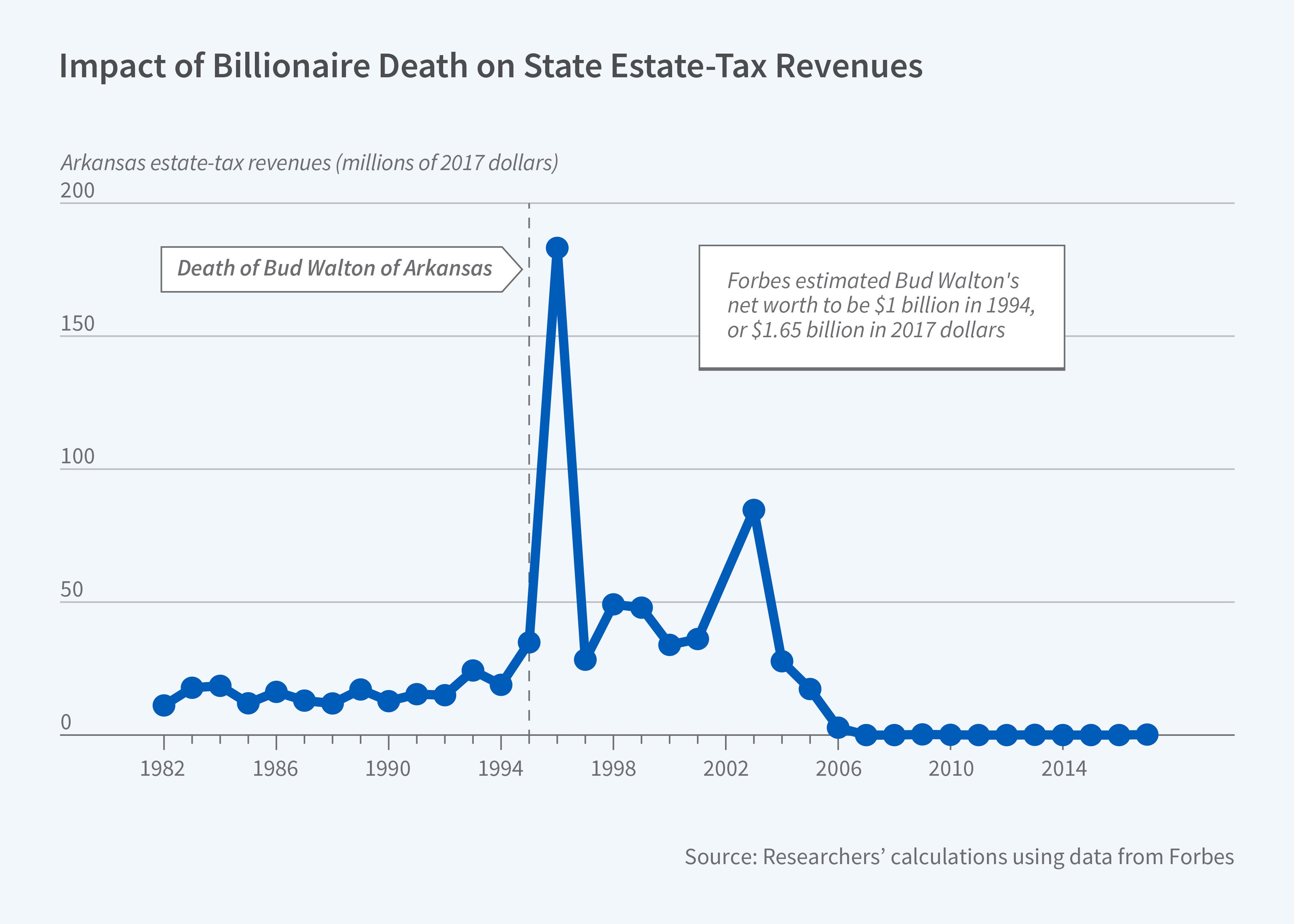

State Level Estate Taxes Spur Some Billionaires To Move Nber

Idaho Estate Tax Everything You Need To Know Smartasset

4 Things You Need To Know About Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Idaho Estate Tax Everything You Need To Know Smartasset

States With An Inheritance Tax Recently Updated For 2020

States With No Estate Tax Or Inheritance Tax Plan Where You Die